Can I Send Money From Cash App to Apple Pay? Understanding Your Options

In today’s digital age, mobile payment platforms have become increasingly integrated into our daily lives. Two prominent players in this arena are Cash App and Apple Pay. Cash App, developed by Block, Inc., allows users to send and receive money, while Apple Pay, created by Apple, enables contactless payments using Apple devices. A common question that arises is: Can I send money from Cash App to Apple Pay? The short answer is no, not directly. However, there are workarounds to achieve a similar outcome. This article will explore the intricacies of these platforms and provide alternative solutions for transferring funds between them.

Understanding Cash App and Apple Pay

Before delving into the specifics of transferring money between Cash App and Apple Pay, it’s crucial to understand the fundamental differences and functionalities of each platform.

Cash App: A Versatile Mobile Payment Platform

Cash App is a mobile payment service that allows users to send and receive money, invest in stocks, and even trade Bitcoin. It operates primarily through a linked debit card or bank account. Users can send money to other Cash App users using their $Cashtag (a unique username) or email address. Cash App also provides a physical debit card that can be used for purchases in stores or online. It’s a versatile tool for managing personal finances and conducting transactions with ease.

Apple Pay: Contactless Payments and Digital Wallet

Apple Pay is a mobile payment and digital wallet service that allows users to make secure payments in stores, in apps, and on the web using their Apple devices (iPhone, Apple Watch, iPad, and Mac). Apple Pay links to credit or debit cards stored in the Apple Wallet app. When making a payment, Apple Pay uses Near Field Communication (NFC) technology to transmit payment information to the merchant’s terminal. It’s known for its security features, including tokenization, which replaces your actual card number with a unique device account number.

Why Can’t I Directly Transfer Money From Cash App to Apple Pay?

The inability to directly transfer funds between Cash App and Apple Pay stems from the design and infrastructure of these platforms. Both services operate within their own ecosystems and do not have a built-in feature to communicate with each other for direct transfers. This is a common limitation among many mobile payment platforms, as each service aims to keep users within its own network.

Direct interoperability would require a complex integration process, which may not be a priority for either company due to business and technical considerations. Each platform has its own security protocols, user authentication methods, and transaction processing systems, making direct integration challenging.

Workarounds for Transferring Money Between Cash App and Apple Pay

While a direct transfer isn’t possible, there are several viable workarounds to get money from your Cash App account to Apple Pay. These methods involve intermediary steps, but they can effectively achieve the desired outcome.

Using a Bank Account as an Intermediary

One of the most common methods is to use a bank account as a bridge between Cash App and Apple Pay. Here’s how:

- Transfer Funds from Cash App to Your Bank Account: In the Cash App, transfer the desired amount to your linked bank account. This usually takes 1-3 business days for standard transfers, or you can opt for an instant transfer for a small fee.

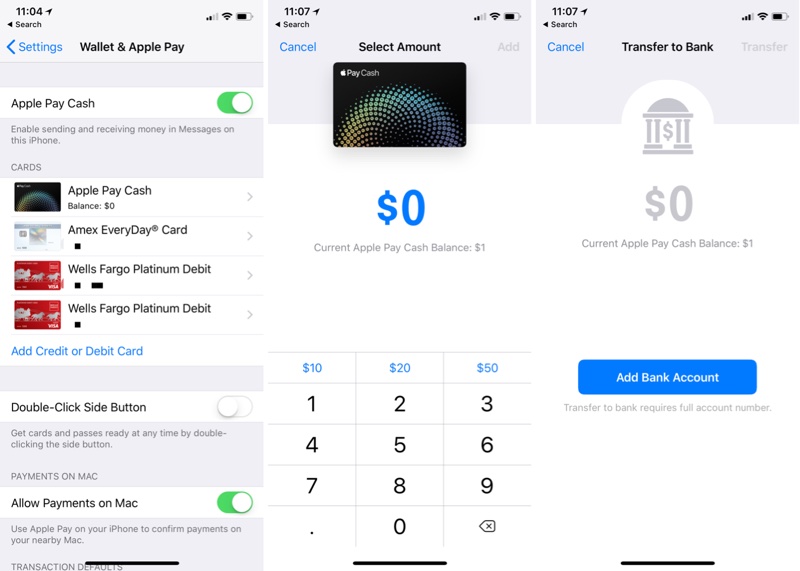

- Add Your Bank Account to Apple Pay: In the Apple Wallet app, add your bank account as a payment method. This involves verifying your account details through Apple’s verification process.

- Use Apple Pay with Your Bank Account: Once your bank account is added to Apple Pay, you can use it to make purchases or send money to others via Apple Cash (Apple’s peer-to-peer payment service).

This method is reliable and straightforward, although it may involve a waiting period for the funds to clear in your bank account.

Using a Debit Card as an Intermediary

Another approach involves using a debit card linked to both Cash App and Apple Pay:

- Link Your Debit Card to Cash App: Ensure your debit card is linked to your Cash App account.

- Add the Same Debit Card to Apple Pay: Add the same debit card to your Apple Wallet.

- Transfer Funds to the Debit Card via Cash App: Use Cash App to send money to your debit card. This will typically involve a small fee for instant transfers.

- Use Apple Pay with the Debit Card: Once the funds are available on your debit card, you can use Apple Pay with that card for payments.

This method is quicker than using a bank account, but it may incur fees for instant transfers from Cash App.

Using Apple Cash

Apple Cash is Apple’s built-in peer-to-peer payment service within Apple Pay. While you can’t directly transfer from Cash App to Apple Cash, you can use the bank account intermediary method to effectively achieve the same result:

- Transfer Funds from Cash App to Your Bank Account: As with the previous method, transfer the desired amount from Cash App to your linked bank account.

- Add Your Bank Account to Apple Cash: In the Apple Wallet, ensure your bank account is set up as a funding source for Apple Cash.

- Send Money via Apple Cash: Use Apple Cash to send money to another Apple Pay user. The funds will be drawn from your bank account.

This method is useful if you need to send money to someone who uses Apple Pay.

Fees and Limitations

When considering these workarounds, it’s essential to be aware of potential fees and limitations:

- Cash App Fees: Cash App charges fees for instant transfers to debit cards. Standard transfers to bank accounts are typically free but take longer.

- Apple Pay Fees: Apple Pay itself does not charge fees for transactions. However, your bank or card issuer may have fees associated with certain transactions.

- Transfer Limits: Both Cash App and Apple Pay have daily and weekly transfer limits. Be sure to check these limits to ensure you can transfer the desired amount.

- Verification Requirements: Both platforms require verification of your identity and linked accounts. Failure to comply with these requirements may limit your ability to transfer funds.

Security Considerations

Security is paramount when dealing with mobile payment platforms. Both Cash App and Apple Pay employ various security measures to protect users’ financial information:

- Encryption: Both platforms use encryption to protect data transmitted during transactions.

- Tokenization: Apple Pay uses tokenization, which replaces your actual card number with a unique device account number, adding an extra layer of security.

- Two-Factor Authentication: Both platforms offer two-factor authentication to prevent unauthorized access to your account.

- Fraud Monitoring: Both platforms have fraud detection systems to identify and prevent suspicious transactions.

Despite these security measures, it’s crucial to practice good security habits, such as using strong passwords, enabling two-factor authentication, and being cautious of phishing scams.

Alternative Payment Platforms

If you frequently need to transfer money between different payment platforms, you might consider using alternative services that offer more flexibility. Some options include:

- PayPal: PayPal is a widely used online payment system that allows you to send and receive money, pay for purchases, and transfer funds to your bank account.

- Venmo: Venmo, owned by PayPal, is a popular mobile payment app for sending and receiving money with friends and family.

- Zelle: Zelle is a payment network that allows you to send money directly from your bank account to another person’s bank account.

These platforms offer different features and may be more suitable for your specific needs.

Conclusion

While you can’t send money from Cash App to Apple Pay directly, there are several workarounds to achieve a similar outcome. Using a bank account or debit card as an intermediary are the most common methods. Understanding the fees, limitations, and security considerations of each platform is crucial for a smooth and secure transfer process. As mobile payment platforms continue to evolve, it’s essential to stay informed about the available options and choose the method that best suits your needs. By leveraging these strategies, you can effectively manage your finances and transfer funds between Cash App and Apple Pay with confidence.

The digital payment landscape is constantly changing, and staying informed about the features and limitations of different platforms is essential for managing your finances effectively. Whether you’re using Cash App, Apple Pay, or other payment services, understanding how they work and how they can be integrated is key to navigating the modern financial world. Keep exploring your options and stay secure!

[See also: How to Link a Bank Account to Cash App]

[See also: Apple Pay vs. Cash App: Which is Right for You?]